south dakota sales tax exemption form

Diplomatic Tax Exemption Program. The South Dakota Department of Revenue administers these taxes.

State Lodging Tax Requirements

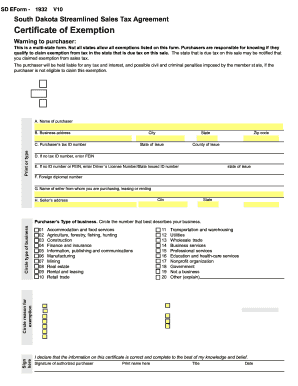

South Dakota Streamlined Sales and Use Tax Agreement SSUTA Certificate of Exemption Instructions Use this form to claim exemption from sales tax on purchases of otherwise.

. A South Dakota resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to. For other South Dakota sales tax exemption certificates go here. You can postal mail or digitally distribute the form for the Division when youve done it.

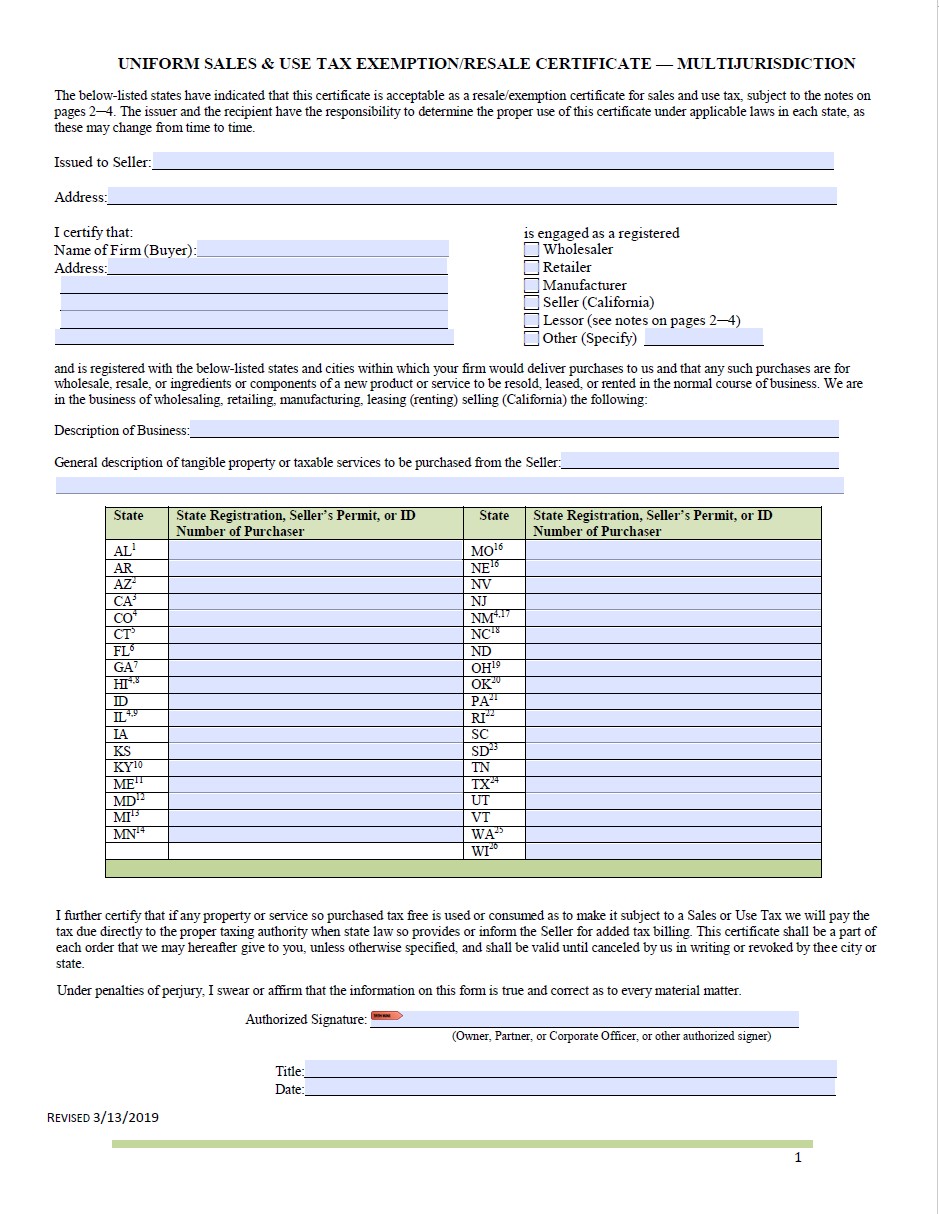

South Dakota Streamlined Sales Tax Agreement Certificate of Exemption Warning to purchaser. North Dakota SSUTA ND. Not all states allow all exemptions listed on this form.

SDCL 10-45-10 exempts from sales tax the sale of products and services to the following governmental entities. The exemption applies only to items purchased. This is a Streamlined Sales Tax Certificate which is a unified form that can be used to make sales tax exempt purchases.

South Dakota Streamlined Sales Tax Agreement Certificate of Exemption Warning to purchaser. There is no restriction on the form of payment that can be used with the card. This form can be downloaded on this page.

South Dakota Streamlined Sales and Use Tax Agreement SSUTA Certificate of Exemption Instructions Use this form to claim exemption from sales tax on purchases of otherwise. Learn what you need to file pay and find information on taxes for the general public. This is a multi-state form.

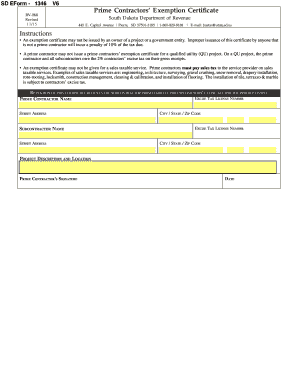

The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. A 2 contractors excise tax is imposed on the gross receipts of all prime and subcontractors engaged in construction services or reality improvement projects. To apply the certificate.

This is a multi-state form. In South Dakota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Everything you need to know about games licensing and beneficiaries of the South Dakota Lottery.

State of South Dakota and public or municipal. Below are the 4 reasons a transaction may be exempt from paying South. Municipalities may impose a general municipal sales tax rate of up to 2.

Several examples of items that exempt from South Dakota sales tax are. Provides access to South Dakota State Governments Online Forms by downloading forms for printing and filling out forms online for electronic submission. Code 57-392-04 Exemptions.

Not all states allow all exemptions listed on this form. Certain nonprofit organizations in South Carolina are exempt from Sales Use Tax on items sold by the organizations for charitable purposes. Sales Tax Exempt Form South Dakota.

Certification of Contractors Exemption. The South Dakota Streamlined Tax Agreement Certificate of Exemption is utilized for all exempted transactions. This is a Streamlined Sales Tax Certificate which is a unified form that can be used to make sales tax exempt purchases in all states that are a member of the Streamlined Sales and Use Tax.

They may also impose a 1 municipal gross. For more information regarding sales tax exemptions please visit pages 11-13.

Form Pt 43 Fillable Application For Property Tax Exempt Status

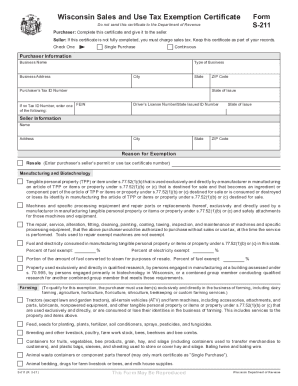

February S 211 Wisconsin Sales And Use Tax Exemption Certificate Fillable 2021 2022 Get And Sign The Form In Seconds

North Dakota Sales Tax Small Business Guide Truic

South Dakota Prime Contractors Exemption Certificate Fill Out And Sign Printable Pdf Template Signnow

Sales Use Tax South Dakota Department Of Revenue

Resale Certificate The Get Out Of Tax Free Card For Eligible Enterprises

4 Reasons A Transaction May Be Exempt From South Dakota Sales Tax South Dakota Department Of Revenue

Sales Tax Exemption Forms By State Store Supply

Which Sales Tax Exemption Form Should Be Used For Each State Printify

What Is A Tax Exemption Certificate And Does It Expire Quaderno

Form Rv 093 Fillable Sales Tax Exempt Status Application

Sales Use Tax South Dakota Department Of Revenue

Form Rv 093 Fillable Sales Tax Exempt Status Application

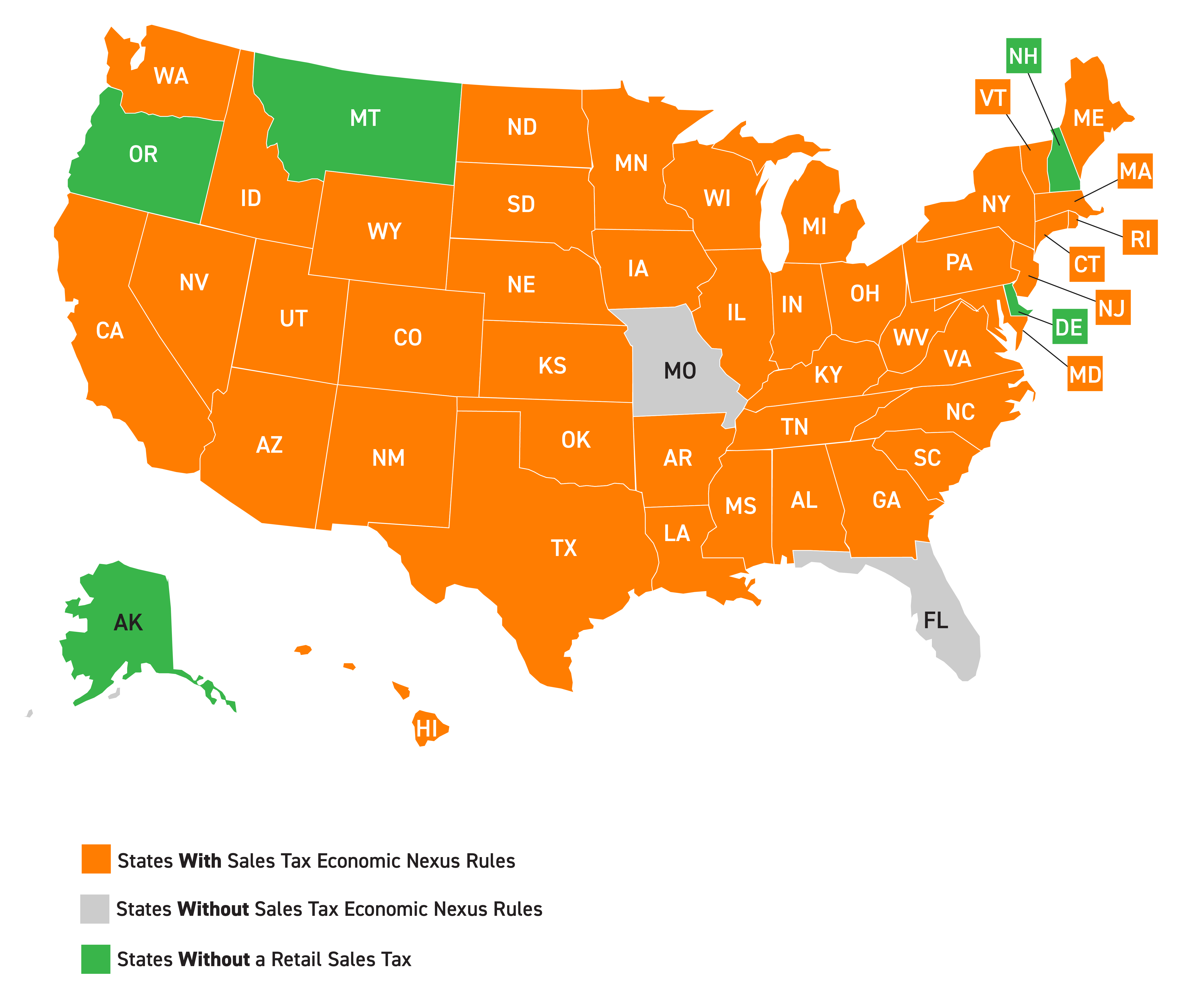

Wayfair Dramatically Changes Drop Shipment Sales Tax Obligations Exemptax Blog

State W 4 Form Detailed Withholding Forms By State Chart

Out Of State Sales Tax Compliance Is A New Fact Of Life For Small Businesses

Exemption Dakota South Fill Out And Sign Printable Pdf Template Signnow